A Florida man pled guilty yesterday after being indicted in a case tied to the now-defunct Florida bitcoin exchange Coin.mx.

Source

Father of Bitcoin Exchange Operator Pleads Guilty to Obstruction

A Florida man pled guilty yesterday after being indicted in a case tied to the now-defunct Florida bitcoin exchange Coin.mx.

Source

Not even Ethereum — a network now worth over a billion dollars, if you combine both its “regular” and “classic” versions — received this much hype at launch. But if the Zcash buzz is just “hype” and not something like “the obvious signal of a shimmering new era in cryptocurrency,” where is it coming from? And more importantly, why is it happening?

Answers to these questions offered in this video — if you don’t want to hear the initial comparison of Zcash to Dash, just skip straight to minute 12:03.

Observing the hype cycles within cryptocurrency — the “pump’n’dumps,” the joys, the sorrows and disappointments — I’ve come to develop a loose and basic theory: that there are two predominant investor types within cryptocurrency at this time. And not much of anyone else.

The first investor type solidified in my mind when MIT released their conclusive report recently on their “Bitcoin giveaway to graduates” experiment.

(Yes, did you know it had been an experiment? Neither did I.)

As a refresher, all graduates of MIT were offered $ 100 worth of free bitcoin in the fall of 2014. Unbeknownst to myself and others, the architects of the giveaway were purposely giving first access to those identified as non-early adopters. Only after that group had been saturated did the architects then offer the bitcoin to those identified as early adopters of technology.

Study architects Christian Catalini and Catherine E. Tucker observed the following:

Our results suggest that when natural early adopters are delayed relative to their peers, they are more likely to reject the technology. We present further evidence that this appears to be driven by identity, […] in settings where the natural early adopters would have been somewhat unique in their tech-savvy status.

Person seeking to feel unique in their tech-savvy status — Investor Type 1.

The second type I’ve identified is the kind of person just looking to make a profit, but lacking in a rigorous knowledge of cryptocurrency fundamentals. Because he lacks knowledge, he therefore doubts his own judgment, and instead looks to authority-types to tell him what he should buy.

This frame of mind is all-too-common within the non-crypto investing world, as well, as succintly pointed out by Christian Bale’s character in The Big Short — you know, the character based on real-life fund manager Michael Burry, who made hundreds of millions of dollars shorting the housing market:

People want an authority to tell them how to value things, but they choose this authority not based on facts or results. They choose it because it seems authoritative and familiar.

Then, person wanting to be told how to value things from a familiar authority figure — Investor Type 2.

A quick glance at this very-public Zcash investor list reveals a whole host of familiar, authoritative faces. Check.

With a simple (or potentially super-) majority of the cryptosphere being made up of two investor types — those seeking recognition as early adopters, and those seeking direction on what to buy — it becomes easy to see where the Zcash hype comes from. It has the appeal both of being brand-new, hence affording early-adopter status, as well as a long list of public investor names to inspire confidence in those lacking fundamental knowledge.

What do you think? Let us know below.

Cover image courtesy of Pixabay.

The post Zcash: Where Is All the Hype Coming From? appeared first on Bitcoinist.net.

Before the weekend kicked off, we highlighted the potential for the breaking of the 700 level to the upside in the bitcoin price as being likely if action continued to move in the way it had done so throughout the week last week. Well, as it turns out, we did see a breaking of this … Continue reading Bitcoin Price Watch; 700 Broken!

The post Bitcoin Price Watch; 700 Broken! appeared first on NEWSBTC.

Hillary Clinton’s decision not to accept bitcoin speaks to the current legal environment surrounding the technology, analysts say.

Source

Apptrade, recently announced at CoinAgenda in Las Vegas, and covered by Forbes contributor Roger Atkins, will hold an ICO with OpenLedger.

Disclaimer: This article is sponsored by Bitcoin PR Buzz.

This ICO is one of three upcoming crowdsales on the OpenLedger platform that will reportedly bring mainstream attention to the ICO method of fundraising, according to the decentralized conglomerate.

Apptrade, calling itself “the stock market of apps,” presents a new way for app developers and publishers to raise funding for their projects. According to a press release, the platform will let developers pool resources that everyone can use as “collateral to attract funding.”

In return, each app benefiting from the pool contributes a portion of its earnings to a shared reserve. Held on a blockchain, OpenLedger said that Apptrade’s resources come with “standardized regulatory features,” which it said will make the app attractive to institutional investors

Furthermore, with its large set of analytical tools, OpenLedger said Apptrade will allow speculators “to easily track the monetary trajectory of portfolios.”

“Apptrade’s Featured Public Offerings and digitally shared reserves have the potential to transform the App investment market in the same way as ICOs have transformed cryptocurrency investments,” said Ronny Boesing, OpenLedger CEO.

“Apptrade’s venture is an innovation in investment finance, one that could have a massive impact on the future of fundraising.”

Apptrade announced its ICO at CoinAgenda last week. Developers will offer an Apptrade-specific token in the crowdsale, which gives holders a 10 percent stake of the app’s market value and future revenue.

“We have the backing and support of [Boesing],” Apptrade founder Daniel Pineda said. “OpenLedger has built the marketplace for smartcoin creation.”

OpenLedger told press that interested investors can contact Ronny Boesing for information on pre-investment arrangements.

Do you think this project will have a successful ICO on OpenLedger? Will it really attract institutional investors? Let us know in the comments below.

Images courtesy of Apptrade.

The post Apptrade to Hold ICO on OpenLedger, Mainstream Investors Expected appeared first on Bitcoinist.net.

Cryptocurrency Arbitrage Trading Robot – Let Your Bitcoins Work for You!

Price: $ 20.00

Sold by Udemy

Tonight we talk with the StashCrypto team Chris Odom, Cliff (Batman) Baltzley and Justus Ranvier about the “Stash Node Pro” an exciting new innovation in not only Crypo Software but Crypto Hardware as well. “It’s a Bank in a Box”. This is not just your run of the mill wallet. It hosts a full Bitcoin node with large block capabilities, as well as multiple other functions, including end to end encrypted messaging hosted on your own personal server via the Tor network.

FB live video feed with behind the scenes commentary: https://www.facebook.com/thecryptoshow/posts/1858238394399532

Original air date 10/29/16 on LogosRadioNetwork

Sponsored by: CryptoCompare.com , Anarchapulco.com and StashCrypto.com

Links:

http://Anarchapulco.com coupon code: Crypto

http://StashCrypto.com http://StashNode.com

http://CryptoCompare.com

http://TheCryptoShow.com

http://FreeRoss.org

http://Facebook.com/thecryptoshow

@TheCryptoShow

@The_Crypto_Show

Tips:

BTC 139R6K7fxTYaFf2aXTid84Le1ayqMVvSCq

Dash XqDeHnokQocBpvffsa2dWz8mX7oTKpoKzc

LTC LUTJtk4QqXLiDkK8pDKK3jM73VVwbp7oSr

Doge DQBJ7PSpFzUTwpBrny46Kug4BW8AGtq1YQ

LTBC 1CevFxMT6srBtTkWx2qrNaJmjtgxbo7pBA

ETH 0x10cfd6916832566e82b3ab38cc6741dfd7e6164f

The Let’s Talk Bitcoin Network

On Wednesday morning at the Money20/20 conference in Las Vegas, a unique and timely panel discussed the emergence and potential applications of Artificial Intelligence (AI) and Machine Learning (ML) in the global, traditional payments arena.

Also read: Technical Analysis: Bitcoin Price to Hit $ 1500 By Year-End?

As computational technology advances, leveraging trends in data and meta-data will help organizations understand both their customers and other businesses more extensively. AI and ML are going to affect all realms of society, and payments are not immune to this trend.

Democratization of tools for analytics in the field will help open up doors for an expanded crowd. As tools and APIs for developers looking towards AI or ML expand, developers will be able to access these complex tools more easily.

Speaking to this, Dr. Arif Ahmed of U.S. Bank remarked how, “With deep learning, you have better ways to conceptualize problems. You see how voice recognition, fraud recognition, and more are improving. You start with the technology, and then you host concepts. . .We have reached a point where this will exponentially increase over the next few years.”

Pattern recognition from AI and ML advancements will have a strong impact as it relates to Anti-Money-Laundering (AML) and Know-Your-Customer (KYC) practices. Particularly in the litigation response matters, Husayn Kassai of Onfido explained how often times remediation work today is outdated.

“The current way that it is carried out isn’t necessarily fit for a digital age,” said Kassai. “It doesn’t make sense to have fully human authentication systems at a bank.”

Ensuring a proper intake of data will be key here, the panel said, as financial services players transition to updated or increasingly distributed backend platforms.

In the future, many consumer-facing products, including chatbots, will make their way into digital services. For lots of financial players, the ability of machines to understand human slander falls short, as placing consumer-facing concerns in context is a major challenge.

People can build chatbots with specific purposes, such as manuals to build a plane or figure out the nature of a mortgage contracts. To minimize errors, look for chatbots in financial services to be developed with specific purposes, such as mortgage loan contracts or ATM interfacing.

David Gilvin of IBM remarked how “AI is always on, 365, 24/7. . .If the machine is making the decision, then fundamentally it is not the same as the financial advisor, it is automated through machine learning. . .not only is it always on, it is everywhere.”

Due to increased regulatory pressures and oversight, AI development in financial services is in a stranglehold. Banks and traditional financial institutions will look towards AI once business models emerge for ways to profit from solution-grade AI-financial software.

Blockchain technology, however, presents a more emergent structure for data storage and application processing such that its inclusion in traditional financial institution circles could lend more easily to AI and ML applications.

Inevitably, the panel said, the regulatory environments at home and abroad will have to adopt. Speaking to this, Martina King of Featurespace echoed the challenges that banks faced in the early days of the internet, and how primitive regulation frameworks created during this timeframe can be changed to help AI and ML applications in banking along.

Finally, in the future, improvements will become more clear to everyone. Stakes for taking an early lead in proprietary software markets in AI and ML to financial services institutions signals the large amounts of money currently on the table.

Adding additional programmatic layers on top of existing disparate financial data should yield massive insights for supply chain providers, retailers, customers, and businesses worldwide. Look for both AI and ML to move away from “black boxes” and more towards proofs-of-concept, similar to the trend that is ongoing in the permissioned-blockchain world. Both applications will likely have a massive impact in the near future!

What do you think about the possibility of Artificial Intelligence or Machine Learning as it applies to financial services, or even blockchain technology? Share your thoughts in the comments below!

Images courtesy of Ryan Strauss.

The post Money 20/20 Panel: Artificial Intelligence and Machine Learning appeared first on Bitcoinist.net.

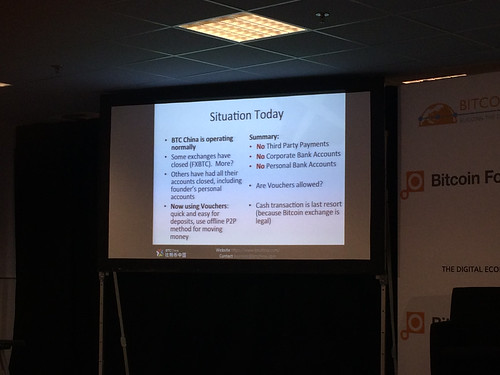

Bitcoin situation in China (Bobby Lee)

Image by Marc van der Chijs

citifmonline.com / Jessica Ayorkor Aryee / Friday 28th October

Acclaimed computer scientist Prof Nii Narku Quaynor has told Citi Business News the introduction of Bitcoin in Ghana will help spur the growth of a cashless society in Ghana.

Bitcoin was introduced in Ghana in February 2016 as part of measures to enhance and promote […]

The post Bitcoin introduction to spur growth of digital transactions appeared first on The Bitcoin Channel.

Bitcoin – Web Wednesday V83 – 069

Image by YB Hong Kong

Bitcoin at Web Wednesday HK – 19th March 2014

83rd social mixer event – networking for the Hong Kong’s internet entrepreneurs and digital media executives.

An interview with two crypto-currency entrepreneurs:

Dave Shin, Founder of Cryptomex, an ambitious alternative for raising company funds via IPOs (initial public offerings) traded in Bitcoins.

Ken Lo, CEO of Anxbtc Bitcoin Exchange, a new marketplace for trading Bitcoins, recently launched in Hong Kong.

More on our blog: bit.ly/wwbv83blog

Photos by bronney.com/

ibtimes.co.uk / Ian Allison / October 28, 2016

The contentious hard forking of Ethereum is often wheeled out by members of the Bitcoin community as a cautionary tale. However, there’s a contingent within Bitcoin that thinks the Ethereum fork was not a disaster at all, a fact validated by the marketplace in cryptocurrency.

The […]

The post If Bitcoin hard forked over block size, what would the market decide? appeared first on The Bitcoin Channel.

DSC03429

Image by Philip McMaster PeacePlusOne_\!/

Etherium Meetup Hong Kong organized by Jehan Chu.

Vitalik Buterin test codes (illustrates) one of the features of Caring Currency using Etherium.

Photo: Philip McMaster, Caring Currency – World Sustainability Project

www.RepublicOfConscience.com

www.WorldSustainability.Org

The operator of a national railway service in Switzerland will begin selling bitcoin through its ticket kiosks starting next month.

Source

Another rise has been recorded. Since our last piece, the bitcoin price has shot up by about another $ 30 and is hanging around the $ 680 mark. Bitcoin just keeps booming away, and it’s plausible that the digital currency could potentially reach $ 700 in the coming weeks if its current streak stays strong.

Also read: Bitcoin Price Watch: Are We About to Hit $ 700?

One source describes the action with a ray of excitement:

“Wow, what a night. We’ve been asking for some volatility in the bitcoin price for the last couple of days, and boy did we get it last night.”

This is the second near-$ 30 rise for bitcoin in the short span of about a week, and several analysts are “blaming” the devaluation of China’s native yuan currency for the alleged spikes in the coin’s price.

As the strength of fiat continues to drop, many asset holders (particularly in China) are seeking ways to retain some form of power and control in their financial futures, and it appears bitcoin is the way to do that. Bitcoin trading and purchasing are at an all-time high in South Asia, and the streak doesn’t seem to be on the verge of stopping anytime soon.

However, there is another side of the spectrum. Sure, people are buying coins left and right. Yes, it is likely contributing to the price hikes, but other investors are touting the power one achieves in simply “holding on” and waiting.

Those with a fair amount of bitcoins in their investment portfolios are sitting around and letting what they have grow. Granted, once they reach a certain point, they will seek to cash out and get their money’s worth. The process is called “hodling,” and is similar to the practices witnessed amongst top stockholders.

One source describes its functions:

“’Hodling’ takes bitcoin off the market, reduces the supply available to everyone else, and increases the price as a result. If could also mean signaling to whoever heeds that you value the asset enough to want to hold it, which in its own interpretation, could warrant keen interest from those who are yet to go into it.”

Hoarding bitcoins is neither wrong nor right; same for spending them. Whatever works to increase the price is probably best, but investors are warned that bitcoin is showing some unusual activity as of late, and it’s unclear whether or not the price is coiling or simply settling and correcting itself. Either way, keep an eye out and keep those bitcoins protected.

Do you think bitcoin will reach $ 700 soon? Post your comments below!

Image courtesy of Bitcoinist.

The post Bitcoin Price Keeps Booming, Another $ 30 Rise in the Books appeared first on Bitcoinist.net.

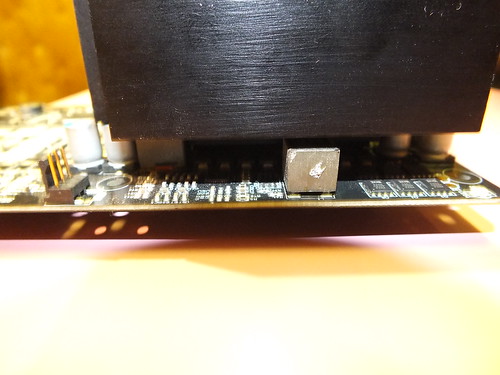

DSCF6154

Image by davispuh

Butterfly Labs 25 GH/s Bitcoin Miner

BitForce Little Single SC

newsBTC | WebMoney Offers Bitcoin Support to Fiat Purses newsBTC WebMoney, the Moscow-based Russian online payment solution platform has announced support for Bitcoin. The new feature enables merchants to accept Bitcoin payments from customers who are not signed up on WebMoney. The latest addition, which … |

Diamond Paperweight 8-24-09 3

Image by stevendepolo

Diamond glass paperweight macro in the sun with reflections. For macro Monday — James Bond Diamonds are Forever.

aucs.jp/genre/daiamond

alexismartinneely.com/2009/11/09/ali-brown-shine-debrief-…

pt4themind.wordpress.com/rules-of-perfection/

www.popsci.com/science/article/2010-02/carbon-compounds-h…

fuckyeahchemistry.tumblr.com/day/2010/02/11/

humantrafficking.change.org/blog/view/are_conflict-free_l…

www.brassmagazine.com/blog/charity

www.k-beeleotards.com/gymnastics-leotards/colors/neutral

www.happinessinthisworld.com/2011/06/26/why-perfect-is-th…

eastmemphis.wmctv.com/news/events/diamond-exhibit-coming-…

face-book.tistory.com/3716

www.wall-street.ro/top/Economie/112299/TOPUL-celor-mai-sc…

www.happinessinthisworld.com/2011/06/26/why-perfect-is-th…

www.businessinsider.com/state-of-diamond-industry-2011-12…

elbitcoin.org/por-que-bitcoin-es-indestructible-segunda-p…

thebeawesomeblog.com/2013/10/13/the-many-facets-of-charac… jackiesaulmonramirez.com/2014/06/24/the-incredible-mom-hulk/

www.trendsderzukunft.de/q-carbon-neuartige-kohlenstoffver…

www.upworthy.com/theres-a-material-thats-harder-than-diam…

arstechnica.com/science/2016/01/diamonds-can-be-used-to-d…

www.dragkamen.ru/convert.html

http://ift.tt/eA8V8J

Ghana is a big time cash society. Cointelegraph decided to find out how far you can go with Bitcoin.

]]>

from CoinTelegraph.Com News http://ift.tt/2fiNjR0

LEOcoin, a cryptocurrency marketed towards entrepreneurs, has launched its mobile application for Android and iOS platforms.

Disclaimer: This article is sponsored by Bitcoin PR Buzz.

According to a press release, the app is informational in nature, providing users with educational resources on cryptocurrency and blockchain technology, as well as real-time data on LEOcoin itself.

The Learning Enterprises Organization (LEO)—the group behind LEOcoin— reported that, within the first days of its launch on Android and iOS, the application got over a thousand downloads

This mobile app comes as the cryptocurrency reportedly gains ground in the world’s major economies. According to the team behind the coin, their “LEO at the Great Wall” event in China during late September was well received, a press release stating that “entrepreneurs, bureaucrats and other important personalities” attended.

LEO started this project with the intent to make a cryptocurrency tailored towards entrepreneurs and businesspeople. The coin advertises the same privacy, speed and security of bitcoin, but with a pure Proof of Stake algorithm that makes the network accessible to everyone.

According to LEO, the community surrounding the cryptocurrency project has grown to over 206,000 members, as well as a strong base of merchants supporting the use of the currency.

“LEOcoin has a huge potential as a cryptocurrency,” cryptocurrency expert Babic Mladen told press. “It is difficult to predict its growth in the immediate future. But, given that this is the next-generation means of payment, there is much to do in the field.”

Expressing optimism for the project, Mladen concluded, “In the long run, LEOcoin and the LEOcoin ecosystem will definitely make it to the top in terms of market cap.”

At press time, CoinGecko reported LEOcoin to have a value of roughly $ 0.5 USD, with a total market cap of nearly $ 42.9 million.

What do you think of this cryptocurrency project? Let us know in the comments below.

Images courtesy of LEO.

The post LEOcoin Project Launches Mobile App on Android and iOS appeared first on Bitcoinist.net.

Today marks the release of Bitcoin Core version 0.13.1. This is the official introduction of Segregated Witness, the long-awaited centerpiece of Bitcoin Core’s scalability road map. Starting November 15, Bitcoin miners can signal support for the proposed protocol upgrade, which, if activated, enables a number of new features on the Bitcoin network as well as an effective block size limit increase.

According to Bitcoin Core developer and Ciphrex Co-CEO, Eric Lombrozo, “Segregated Witness is the biggest extension of the protocol to date.”

Segregated Witness

Segregated Witness is a proposed upgrade to the Bitcoin protocol first introduced by Bitcoin Core and Blockstream developer, Dr. Pieter Wuille, at the Scaling Bitcoin conference in Hong Kong in December of 2015. The technological innovation separates signature data from Bitcoin transactions. This has several advantages, including — but not limited to — a malleability fix, more flexible programmability, and an effective block size limit increase.

“It’s the most significant improvement to the protocol to date, and lots of exciting innovations become possible as a result,” Lombrozo told Bitcoin Magazine. “We’re going through a period of tremendous innovation in Bitcoin — the greatest innovations since Bitcoin’s inception are taking place right now.”

Segregated Witness has been in the pipeline for almost year. Wuille started coding it in November 2015, and was joined by Lombrozo, Johnson Lau and several other Bitcoin Core developers in the following months. Counting almost 5,000 lines of code, Segregated Witness was completed last April.

Since that time, the proposed innovation has been subject to rigorous checks and analysis. Lombrozo explained:

“We’ve done a lot of review, and a lot of testing. We’ve had three dedicated Segregated Witness test networks, and it has been successfully running on Bitcoin’s main testnet since May. Additionally, compact blocks had to be developed and integrated in Bitcoin Core to mitigate latency and bandwidth issues. This was included in the latest version, 0.13.0.”

Activation

Segregated Witness is a proposed soft fork; a change that technically makes Bitcoin’s protocol rules more restrictive.

Activation will follow the standards as established by Bitcoin Improvement Improsal (BIP)9. This means that, within a single difficulty period of 2016 blocks (about two weeks), at least 95 percent of blocks must be mined by a miner that signals support for Segregated Witness. If this threshold is reached, the following difficulty period allows everyone who wants to upgrade the chance to do so. After that, Segregated Witness support is activated, and Segregated Witness transactions are accepted by Bitcoin miners.

Signaling will start on November 15. In the earliest possible scenario, this means that Segregated Witness could activate by mid-December. That seems somewhat unlikely at this time, however. A relatively new Chinese mining pool — ViaBTC — recently indicated it will not support a Segregated Witness soft fork. As ViaBTC currently controls about 9 percent of all hash power on the network, it could effectively block activation — assuming it remains above at least 5 percent.

Lombrozo indicated that the Bitcoin Core development team is not too worried, however.

“Changes to the consensus rules are hard by design,” he said. “In this case, I think the benefits vastly outweigh the risks, as Segregated Witness enables a bunch of new innovation in Bitcoin that will improve scalability and will allow for more use cases. My hope is that miners will appreciate these great benefits and will want to take advantage of this significant improvement to the protocol.”

If Segregated Witness is not supported by 95 percent of hash power by November 15, 2017, it can no longer activate. Until then, it’s unlikely that Bitcoin Core developers will present an alternative proposal, Lombrozo said.

“We’ve worked very hard to find a path forward that gives everyone in the ecosystem something they want,” said Lombrozo. “It’s not always possible to please everyone, but we’ve made a great effort. We put this forward for the community. I hope the community appreciates our work and likes what we’ve done. At this point, it’s in the community’s hands to decide its fate.”

Bitcoin Core 0.13.1 can be downloaded from bitcoincore.organd bitcoin.org.

For more information on Segregated Witness, see Bitcoin Magazine’s three–part series.

The post Segregated Witness Officially Introduced With Release of Bitcoin Core 0.13.1 appeared first on Bitcoin Magazine.

The CME Group is launching two previously announced bitcoin price benchmarks next month.

Source

Bitcoin Barcamp

Image by Halans

New York based startup Mediachain Labs has announced the launch of Mediachain Attribution Engine, a blockchain-agnostic application built using Mediachain, an open media library built on top of the InterPlanetary File System (IPFS) with support for multiple blockchains, including Bitcoin and Ethereum. The Mediachain Attribution Engine application will help users find high quality and properly attributed images that can be used for any visual imaging needs — on websites, in blog posts and presentations, and more — while allowing publishers and creators to secure the rights of their digital content.

Speaking to Bitcoin Magazine, Mediachain Labs Co-Founder, Denis Nazarov, said that unattributed content shared on the internet not only gives rise to plagiarism but also prevents people from connecting with the content creators. He adds, “attribution is fundamental to the creative process because it guarantees that creators can connect directly with their fans, but the currently available content attribution systems are inefficient.”

“People care about connecting with creators, but the ability to easily do that is currently broken. It’s really easy to share images by copy and pasting them, but that usually means you break the chain linking to the creator,” Nazarov said. “This means that when someone is looking at a great image that they love in their feed, they have no idea who made it or anything about it.”

“The goal of Attribution Engine is so that audiences can always connect, like, upvote or even tip, someone whose work they admire directly through the media itself.”

How it Works

The Mediachain Attribution Engine is built on top of the Mediachain open media library project. It will allow publishers and content creators to upload their content and attach information to their media, which will then be time-stamped in the Bitcoin blockchain and stored in the IPFS. The information can then be looked up via perceptual search using an instance of the media itself.

“Attribution Engine makes attribution as easy as copy/paste, and more importantly, all the data Attribution Engine is built on is open and decentralized, meaning any developer can download the data, or even extend it by contributing directly to Mediachain,” Mediachain Labs Co-Founder Jesse Walden said to Bitcoin Magazine. “This means Mediachain attribution can be automatically integrated in any application. It gives developers access to a universal, open media library full of great content that they can use in new, innovative media applications, obviating the need for consumers to manually attribute content.”

Users can search the Mediachain open library database using the Mediachain Attribution Engine for images they want to share. Once they find an image they like, they can copy and paste the html code of the link to their blog post or website. The attribution for the image is embedded in the html code itself, hence there is no further need on part of the user to manually attribute the image. The Mediachain Attribution Engine currently doesn’t support sharing of the images directly to social media sites, but Navarov said they are looking forward to adding that feature.

“The internet is really good at helping creators reach a large audience, but when media is shared virally, it often loses any connection to it’s creator, it’s orgin and it’s story,” said Walden. “Mediachain enables a channel to discover the identity of the creator anywhere their media is shared, enabling a connection with the full scale of their audience so they can derive all the benefits of achieving scale on the internet.

He added, “It’s important to note that this means there is more incentive for creators to post great content online, as opposed to approaches that try to impose artificial scarcity for media that is categorically ‘out there.’”

Future Prospects

The current participants in the Mediachain project are The Museum of Modern Art (MoMA), Getty Images, the Digital Public Library of America (DPLA) and Europeana Collections. All of the content on the Mediachain database is used under the Creative Commons license; however, Nazarov said that their goal is to expand to commercially licensed content that will allow creators and publishers to monetize their content.

“Creative Commons is our first use to demonstrate how Mediachain works end-to-end,” Nazarov said. “We think openly-licensed media is a great fit for a decentralized media library. But the goal is to expand to commercially-licensed content in the near future. The same channel that is used to transfer attention directly to creators in Attribution Engine today can be used to send a payment tomorrow, all with no middlemen.”

Mediachain is currently accepting attributed content from verified Creative Commons sources only, including any Creative Commons images from Flickr, a site that is often mined for images. The Attribution Engine for creators is currently in private beta but interested parties can sign up for the public beta here.

The post Mediachain Labs Launches Blockchain-Based Content Attribution Engine appeared first on Bitcoin Magazine.

That's only the words of extremist of bitcoins fans and field IMO, I think it's still too early for bitcoin to actually replace fiat or change the financial system. Bitcoin can be a great currency on the online field and for conducting transactions thr…

Bitcoin Forum

Bitcoin IMG_3159

Image by btckeychain

Different stores and representations of Bitcoin.

Blockchain company Gem aims to tackle one of the biggest issues in health care insurance claim payments: providers have to wait a long time to get paid. Moving toward that goal, the ambitious startup just scored a major partnership with Capital One.

In a recent press release, Capital One announced it is “reinventing” its treasury management platform to include, among other things, advances in health care claims applications. As part of that, the financial conglomerate is partnering with several digital technology providers, including Gem.

“Blockchain technology connects the ecosystem to universal infrastructure, and shared infrastructure allows global standards that do not compromise privacy and security,” said Capital One in its press statement.

“When providers don’t get paid in a timely fashion, it creates inefficiencies that echo across the entire ecosystem, and this is a massive issue in health care,” explained Emily Vaughn, Director of Client Relations and Marketing for Gem.

Gem’s core product is GemOS, an abstraction layer designed to make blockchains useful for enterprise clients by connecting their existing software to shared ledgers. According to Vaughn, GemOS is similar to an operating system, in that it serves as a platform for managing data, identities and rules on a blockchain.

To get an idea of how this works consider that, in a basic workflow revenue cycle, the health care provider will creates a claim. They in turn send it to the payer, who then approves or denies the payment portion of it. Then the payer sends that information to their bank, who then sends money to the provider’s bank.

In that workflow, you have four companies all running on different systems trying to communicate about the same event. On a shared ledger, you need instead four identities, four permissioned users on the network.

The GemOS key management service creates identities for the payer, provider and their respective banks, using hierarchical deterministic (HD) identity keychains. HD keychains were invented to secure bitcoin and are now the industry standard. They allow the user to have a secret key that generates many public keys to protect the identity of the user.

“Like a bitcoin wallet, your blockchain identity can store data, such as credentials, ” said Vaughn. “You use that identity to sign transactions, which is now visible to other users who could be using different software. We call this, Multiparty Identity and Access Management.”

In that sense, GemOS acts like a permission layer between different blockchains, controlling who should have access to data stored in disparate siloed systems, as well as when they should have that access.

It is not uncommon for large enterprises to have critical data spread across different systems that don’t communicate well with one another. In the health care industry, those interoperability issues can lead to payments delays and other problems, like patients not having access to a complete aggregated view of their health. But privacy is also a huge issue in health care, making it doubly difficult to gain access to enterprise systems.

Earlier this month, at the Distributed: Health conference in Nashville, Tennessee, Gem introduced its Revenue Cycle Management (RCM), a pilot project that runs on the GemOS platform and is supported by the Gem Health Network, a network for developing applications and shared infrastructure for healthcare powered by the Ethereum blockchain.

“The Gem Health Network is the blockchain network we spun out so our customers can build applications in a sandbox environment where they can test their application’s ability to leverage a shared infrastructure, which is the blockchain network,” said Vaughn.

Philips Blockchain Lab, a research and development center of healthcare giant Philips, was the first major healthcare operator to partner with Gem. Capital One is now the second.

“At Capital One we see the new network models and data analytics capabilities as an exciting opportunity to reinvent treasury management to better meet the needs of clients, not only increasing payment efficiency but also generating actionable information about their business,” Capital One Executive Vice President, Patrick Moore, said.

Nearly a year ago, Capital One was one of several financial industry players to invest a total of $ 30 million in Chain.com, a blockchain developer platform that serves the fintech industry. Its current partnership with Gem marks the first time Capital One has publicly announced the intention to use a blockchain in one of its actual products.

The post Gem Partners With Capital One for Blockchain-Based Health Care Claims Management appeared first on Bitcoin Magazine.

27-13_50_24-01-7D2_0028

Image by O’Reilly Conferences

MMM Global hurts Bitcoin business in Africa, Bitpesa Bitcoin exchange warns its users on the need to be cautious.

We asked for action in the bitcoin price, and it’s action we got. Things haven’t been this active on the intraday charts for months, and it finally looks like price might make its way through the elusive 700 mark near term. If it does, we expect a considerable upside momentum run as the shorts are … Continue reading Bitcoin Price Watch; The Upside Continues!

The post Bitcoin Price Watch; The Upside Continues! appeared first on NEWSBTC.

PayPal Commerce Factory Sydney – Bitcoin

Image by developer_steve

From Bitcoin and beyond we look at where it all began from its inception to its current day notoriety helping shape the way in which we pay. We also look at what it means for consumers and merchants and how it can be easily integrated into new and existing platforms.

&8230nThe post Outgoing Transactions Arent Being Pushed to Bitcoin Network, Says Coinbase Before Fix appeared first on CryptoCoinsNews.n

CryptScout #BitFeed RSS – Bitcoin and Cryptocurrency News 24/7

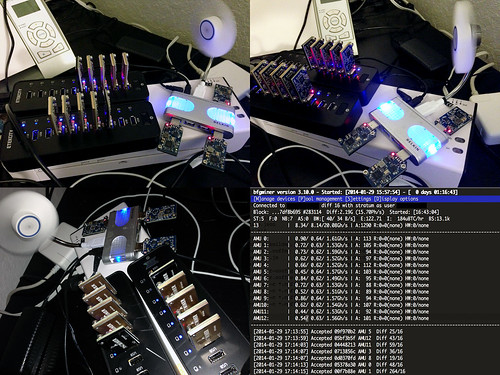

mini bitcoin farm

Image by blackpawn

gotta get better usb hubs, these can’t handle too many miners before crapping out

http://ift.tt/eA8V8J

Coinplug, a bitcoin wallet service provider and infrastructure developer funded by billionaire investor Tim Draper in 2014, has partnered with South Korea’s fourth largest bank KB Kookmin to test its blockchain infrastructure’s cross-border payment efficiency.

In December 2015, KB Kookmin and Coinplug established a memorandum of understanding (MOU), to form an official partnership and relationship in the investigation and implementation of the blockchain technology.

The KB Kookmin financial services department was particularly appealed by the flexibility and functionality Coinplug’s blockchain infrastructure to allow both international and domestic settlement of transactions without surpassing the SWIFT network.

SWIFT, which stands for the Society for Worldwide Interbank Financial Telecommunications, makes cross-border payments substantially more expensive than autonomous settlement systems like blockchain due to its requirement of manual confirmation of transactions.

Upon the signing of MOU, KB Kookmin agreed to test the blockchain technology’s potential in the mainstream financial market and provide commercial services through the development of innovative business models.

KB Koomin representative stated, “through the MOU, KB Kookmin will offer faster and more secure international payments. The bank will focus on meeting the demands of our consumers by utilizing the blockchain technology.”

Earlier this month, KB Kookmin executive Yoon Jongkyu and Coinplug managing director Eo Jooseon officially announced that the two organizations successfully tested a proof-of-concept (POC) blockchain-based international transaction settlement service.

Both executives stated that it is first case of successful blockchain testing in South Korea, and KB Kookmin will most likely strategize various methods of utilizing the POC blockchain infrastructure commercially.

KB Kookmin executive emphasized that its pilot test will be used to lead the Asian blockchain market by providing a platform for other banks and financial institutions.

In response, Coinplug’s Eo wrote, “Coinplug will collaborate with KB Kookmin in making an advancement in the blockchain and financial markets of South Korea. The implementation and growth of the blockchain technology will rapidly increase in the near future and we will provide relevant commercial applications to match the pace of the industry.

Apart from its blockchain services, Coinplug is also the only startup in South Korea to provide unique bitcoin trading methods to local consumers. For instance, the startup recently introduced a service called ATM Wire, which allows local users to purchase or sell bitcoin at tens of thousands of convenience stores around the country.

Over the next few months, Coinplug wil…

Who really understands what a blockchain is? Could you explain it to your mother? Chain CEO Adam Ludwin got down to fundamentals yesterday, as he explained his company’s intention to transform financial services by digitizing already-existing assets.

Also read: Visa Introduces Blockchain-based Solution for Payment Services

Ludwin spoke on a Tuesday afternoon panel with at the Money 20/20 Conference in Las Vegas.

Adam Ludwin

Assets including U.S. dollars and Starbucks points could move on blockchains with greater efficiency and security, he said.

“A blockchain is actually a new type of database,” he said, adding that it’s a “boring” topic that only fills conference halls because it involves money and wealth. These aspects still have the power to transform financial services and thus society though, he added.

“A blockchain is like a digital network of safety deposit boxes, in the sky.”

You don’t have physical possession of a safety deposit box but you do have a key, he said. Anyone can have control of those keys, individuals and institutions.

Other (non-blockchain) FinTech models are trying to transform financial services from the top down, connecting back into existing infrastructure like banks. Blockchain, on the other hand, starts at the bottom of the stack, with the creation of the asset itself. Then it works up from there.

Bitcoin seeks to build a financial system completely outside any existing network, Ludwin said. When Bitcoin proponents talk about moving away from the dollar completely it sounded like “I’m going to get shotguns and bitcoins and go live in the mountains,” he quipped, adding that he still thinks Bitcoin is “great”.

Most of what you’ll hear about Chain from now on will be from partner firms like VISA, he said. The company is moving out of the “hype cycle” and wants to focus on real-world results.

A day earlier, Chain also announced it is open-sourcing its platform, and published its technology roadmap for the next five years.

Moderator Robert Hackett of Fortune asked if there is any “snake oil” in the industry. Ludwin replied it’s good to see a Darwinian-style winnowing-down of those projects focusing on hype more than real outcomes — which is common in all tech sectors.

Chain launched in April 2014 as a company building Bitcoin APIs. The intent was to build tools to make life easier for Bitcoin developers. After demonstrating the technology to clients, however, they asked fundamental questions about how blockchains actually move value. And in doing so, they opened the Chain team’s eyes about how financial networks functioned.

“There’s a real problem in the market around asset movement,and security and custody, and it’s a much bigger and harder problem,” Ludwin said. Neither Bitcoin, Ethereum nor even Ripple was designed to solve this. Chain then put its heads down for two years to develop the technology it’s releasing right now.

Chain has sat down with executive-level employees at financial services firms to get a better understanding of their needs.

Their companies have proprietary assets (such as loyalty points) and they want to control the networks those assets move on, Ludwin said. They don’t see open, public blockchains as a viable option.

It’s important for networks like Bitcoin and Ethereum to remain decentralized, he said, because that’s the whole reason they exist. Permissioned blockchains are more about finding the least amount of centralization its participating entities need. Each node can control a different function in the consensus process.

Chain sees itself as halfway between existing financial infrastructure and the Bitcoin network, he said. The aim is to integrate with what exists rather than trying to replace everything.

Is Ludwin right about the nature of blockchains and how they can transform our world? Let’s hear your thoughts.

Images via: Money 20/20, Chain

The post Only Permissioned Blockchains Can Transform Finance, Says Chain’s Ludwin appeared first on Bitcoinist.net.

After last week’s shocking 6-6 tie between the Cardinals and the Seahawks, this week in NFL starts out on Thursday night when the Jaguars face the Titans. The Dallas Cowboys are coming off a by week and face the Eagles at home, and the Pathers are also coming off a by week and face the Cardinals at home. Will the Panthers be able to bounce back after a terrible start of the season? This will be a good test at home for the Panthers.

Also Read: Trump vs. Clinton: Bet on America’s Future With Bitcoin

How can you bet on the games? The easiest way to bet on the NFL is to use Bitcoin. You can load your sportsbook account and get a bonus for depositing. Let’s take a look at one of the big games this week.

Patriots Vs. Bills

This rivalry is not only players vs. players but a battle of coaches Rex Ryan vs. Bill-Belichick.

This time, the Pats travel to Buffalo will be a road favorite, a position they are used to being in. At first glance, you might think that the Bills do not have a chance. However, last year the Bills destroyed the Pats 16-0, as the saying goes, “on any given Sunday.”

Currently, the Bills are 4-3 and in second place in the AFC East, and the Pats are first in the division at 6-1, losing only to the Texans. On paper, New England is getting almost 100 yards more in passing yards per game and Buffalo has about 30 yards more rushing per game. The rest of the offensive stats are about even. On defense, both teams have been on the field 456 times, and the Bills have only given up ten more yards as the Patriots.

Line Movement

One of the most bet-on teams in the NFL is the Patriots. Last week against the Steelers, around 90 percent of the bets were on the Patriots — with only 10 percent on the Steelers.

The Patriots are a “public” team. Everyone and their mom throws money at the Pats, and a lot of the time they do not really pay attention to the odds or the point spread. This time around, you are going to want to pay attention to the point spread.

This line started at -5 Patriots and is already at -6.5. If you are going to bet on New England, go ahead and do it now when you can get anything -7 or less. If you want to bet on the Bills on the spread, then you should wait. There should be plenty of public money coming in on New England on Sunday, and the line could go to -7.5 or higher and then you can take Bills +7 or higher.

Picks

My two picks are Patriots -6.5 and first quarter under 7.5 points. The line for the first quarter is not out, but I expect the defenses to be fresh, and both teams will be happy to start with a field goal if they are in the distance.

Theo and Tony go over all the odds for this week´s NFL games

When you are betting on NFL, do not forget the most common margins of victory. Most games have a margin of victory of 3 or 7 points. The difference between -7 and -7.5 is huge. If you can bet on spreads that cross the common margins of victory, you have increased your chances of winning significantly. If you are betting on an underdog consider placing half your bet on the Moneyline (outright win no spread) and half on the point spread. Do not overbet.

There are games every week, and there is no reason to bet on every game.

What are your picks? Do you have questions about point spreads? Post them in the comments below!

Cover image courtesy of kicx917.com.

Bitcoinist is not responsible for any gains or losses incurred while gambling.

The post NFL Week 8: Bet on Football With Bitcoin appeared first on Bitcoinist.net.

Es un pequeno resumen informativo sobre la nueva moneda anarco-criptografica Bitcoin. Se hace una reflexion sobre su situacion actual y su futuro previsible. Se indican los conocimientos basicos necesarios que conviene saber para poder operar con esta mon

Price: $ 7.00

Sold by Wal-Mart.com USA, LLC

n n n After last week&8217s shocking 6-6 tie between the Cardinals and the Seahawks, this week in NFL starts out on Thursday night when the Jaguars face the Titans. The Dallas Cowboys are coming off a by week and face the Eagles at home, and the Pathers are also coming off a by week and face the &8230nThe post NFL Week 8 Bet on Football With Bitcoin appeared first on Bitcoinist.net.n

CryptScout #BitFeed RSS – Bitcoin and Cryptocurrency News 24/7

LAS VEGAS — At CoinAgenda, OpenLedger CEO Ronny Boesing said his company is “taking ICOs mainstream” by opening pre-investment to 3 new funding projects, all of which are unrelated to the cryptocurrency market.

Disclaimer: This article is sponsored by Bitcoin PR Buzz.

Boesing said that the three incoming ICOs will be fore Apptrade, Centz and Beyond the Void, all of which will reportedly attract institutional investors to the ICO funding method.

“Apptrade, Centz, and Beyond the Void all show applications of blockchain technology to mainstream audiences,” Boesing said. “By accelerating their ICO crowdfunding, we’ll accelerate the spread of ICO culture and practices as well.”

Apptrade brands itself as “the stock market of apps,” combining ICO investment with token trading to, according to OpenLedger, “revolutionize how the app industry gets funding.

In a press release, OpenLedger explained that Apptrade “helps publishers leverage their exposure with cross-marketing and collaborate funding via app portfolios.”

The platform competed in front of BitAngels investors this week at CoinAgenda.

Centz is a gift card service, making balances on all gift cards tradable for a specialized currency called “Centz Gold Bucks.” According to the service’s website, multiple gift cards can be lumped into one spendable sum on a mobile wallet, including cards with fractional balances. The comapny also claims to provide a “comprehensive approach” to security and fraud prevention.

Finally, Beyond the Void is an upcoming MOBA game that centers around battling spacecraft called “motherships.” The game will use a blockchain-based token system to facilitate buying and trading vanity items for player personalization. Developers told press that this item market will make up the game’s main revenue stream.

All three of these companies will launch ICOs on the OpenLedger cryptocurrency exchange, which has gained popularity in the blockchain community for hosting several high profile crowdfunding campaigns. The company recently began calling itself a “decentralized conglomerate” after adding services beyond cryptocurrency trading, including advertising, “blockchain talent,” and ICO marketing.

Do you think these ICOs will draw mainstream attention? Let us know in the comments below.

Images courtesy of OpenLedger, Apptrade

The post OpenLedger: 3 New ICOs Have Crypto ‘Going Mainstream’ appeared first on Bitcoinist.net.

A small tweak to bitcoin could have a big impact.

Source

Poor Man’s Bitcoin Mining Rig

Image by brownpau

ASICMiner USB Block Erupter with fan in USB hub taped to card stand; not an epic rig by any stretch of the imagination but fun for pulling in 0.01 BTC or so per week.

http://ift.tt/eA8V8J

South Korea has announced that it is now putting measures in place for the spread of top digital currency, Bitcoin.

]]>

from CoinTelegraph.Com News http://ift.tt/2eGm2Et

_MG_1416

Image by Philip McMaster PeacePlusOne_\!/

Tianjin Bitcoin Adventure & Party

Photo: Philip McMaster

DuckEcoin

We Are Change

In this video Luke Rudkowski talks about the latest Hillary Clinton election scandal as her operatives are caught red handed at the American United For Change operation implicating her. Find our more and stay tuned by investing in us on https://www.patreon.com/wearechange

Support WeAreChange by Subscribing to our channel HERE http://www.youtube.com/subscription_c…

Visit our main site for more breaking news http://wearechange.org/

Patreon https://www.patreon.com/WeAreChange?a…

SnapChat: LukeWeAreChange

Facebook: https://facebook.com/LukeWeAreChange

Twitter: https://twitter.com/Lukewearechange

Instagram: http://instagram.com/lukewearechange

Rep WeAreChange Merch Proudly: http://wearechange.org/store

OH YEAH since we are not corporate or government WHORES help us out http://wearechange.org/donate

We take BITCOIN too

12HdLgeeuA87t2JU8m4tbRo247Yj5u2TVP

The post BREAKING: The NEW Election FEC Violation That Should End Clinton’s Campaign appeared first on We Are Change.

Ether will be back soon:)

[…

I never heard about deep web bitcoin accounts. What is bitcoin account? There is no way this is something legal, and my recommendation is to stay away from this. Never trust in something that you don`t know nothing about, before buying anything you nee…

Bitcoin Forum

As content becomes more and more abundant and immediately available at our fingertips, our limited attention is a barrier for those whose business it is to attract and harness it. In this context, large (social) media companies understand that attention is a scarce commodity, and, as has been demonstrated, those who control attention wield enormous power over our society.

We’re joined by Greg Meredith, CTO of Synereo, to talk about how this new Blockchain platform rebuild the attention economy. In a sense, Synereo is to attention, what Bitcoin is to money, in effect, removing intermediaries from the transaction between those who have attention, and those who wish to attract it. Greg, also gives his insights on how functional programming languages could allow for verifiable computational smart contracts.

Topics discussed in this episode:

Links mentioned in this episode:

Sponsors:

Show notes

YouTube

SoundCloud

Epicenter is hosted by Brian Fabian Crain, S?ƒbastien Couture & Meher Roy.

The Let’s Talk Bitcoin Network

The day that a quantum computer is able to decrypt and take Bitcoin apart is the day that says that quantum computing has arrived. Will it destroy the Bitcoin economy? Sure it might but let us look at the bigger picture here. Putting our own self inter…

Bitcoin Forum

On Monday afternoon at the Money20/20 Conference in Las Vegas, Ethereum lead developer Vitalik Buterin, and Don Tapscott, author of Blockchain Revolution, took center stage to speak to the groundbreaking potential of the Ethereum network.

Also read: Money 20/20: Cybersecurity Panel Praises Information Sharing to Reduce Cybercriminal Risks

Buterin started off by going over his history within the Bitcoin space, going back to when he first learned about the technology in 2011, and then his involvement in various “Bitcoin 2.0″ projects starting in 2013 and onward.

Bitcoin as a network is optimized to append the text-based list of who-has-what, Buterin said, not run complex applications on a distributed blockchain network. To answer this problem, he began creating the Ethereum network, where each node doubles as a virtual machine and can run applications on the native scripting language and cryptocurrency, called Ether.

Don Tapscott, Author of Blockchain Revolution, framed the narrative early. “The internet is entering a second era,” he said. “We’ve seen the internet of information for many days, and now we are seeing the internet of value.” As the internet evolves, traditional infrastructural technology in the financial sector needs updating to lower reconciliation and overhead costs.

Banks are going to have to change, Buterin claimed, the technological developments in financial infrastructure are inevitable. Banks have to adopt in turn to oncoming decentralization technological pressures.

As Buterin put the ongoing struggle, “Automated contract execution has a lot of exciting applications in general.” Centralization in payments infrastructure is also a bad idea, Buterin argued, echoing, “with credit cards, this is an insane notion that to make a payment you have to give an actor your private keys.”

A major problem of Ethereum and Bitcoin blockchains is delay times due to an increasingly costly and crowded blockchain. With realistic scalability goals around 100,000’s of transactions per second, Ethereum would need to implement their Proof-of-Stake (POS) architecture to raise from the embryonic level of 15 transactions per second currently.

When discussing the possibility of redacting data from a blockchain solution, full-immutability may not service a societally beneficial purpose. Speaking to the notion that “Code is Law” and miners will have the final say over the networks, Buterin reiterated the final say that miners have over a given network, stating, “The fact is that you can 51% attack Ethereum or Bitcoin when you get that mining power. So you need to be realistic about where these systems stand today.”

At the end of Vitalik’s interview, Tapscott asked what the future holds for banks. “Are the banks toast?” he asked.

Buterin responded, “Toast, french toast!”

In the second panel of the day, an all-star lineup consisting of former White House executive Jamie Smith, BTCC CEO Bobby Lee, and serial entrepreneur Eric Martindale spoke to the multi-faceted nature of blockchain technology.

Security and maintenance of the decentralized Bitcoin network is what gives the system finality, the panel established. In this sense, Bitcoin holds unique benefits, because the security on the extremely computationally intensive Bitcoin network enables for a secure list of who owns what to append without opportunity for redaction or recourse.

As Lee put it, “you can’t print more Bitcoin!”

The panel also raised an industry-wide problem, where as long as customers are not holding their own keys, then the companies who are managing funds on behalf of the customers essentially become centralized entities themselves in turn.

Bitcoin is not even in its 8th year, is still very young, and yet the Bitcoin blockchain itself is open to be compromised. Mr. Martindale echoed the paradigm shifting nature of these changes, stating, “These (blockchain) changes are exponential, we need to re-evaluate everything at a deep level, if you can sign with a private key then no authority can take that (capability) away from you.”

While advances in the space are occurring rapidly, it is important to remember that blockchain technology is a double edged sword. Especially as cybersecurity attacks take on increased sophistication, the blockchain space is writing history as the industry progresses. Jamie Smith detailed use cases that BitFury is undertaking with the Blockchain Trust Accelerator, including land titling in Georgia, vaccine dissemination in developing countries, and other solutions in the marketplace that can help in solving a social good.

Still, potential for Orwellian monitoring of transactions on a blockchain needs to be approached with caution.

“Everyone in the world will have a phone, and will have wifi, and if now people can transfer a digital asset for free, then what do we do about that? We all need to ask themselves this,” said Mrs. Smith.

At the end of the talk, the panelists were asked to predict the price of Bitcoin in one year’s time. Eric Martindale thought a 10x growth to $ 6,000 per Bitcoin was in reach, but Bobby Lee saw things doubling. Jamie Smith thought that the industry could do better with branding and communication, leveraging the human spirit to explain blockchain technology and Bitcoin succinctly and accurately to a wider audience.

To round out the day, a team of experienced industry investors across the blockchain space discussed the investment environment in the industry. What is starting to emerge as a Linux-type operating system — geared towards hardcore techies — blockchain investments have a rocky track record at best. In turn, the space needs more success stories to demonstrate narratives which show success stories of real-world implementation and show the power of investing in R&D development.

Past paradigm-shifting technological changes such as the radio or internet have evolved way beyond initial use cases to realize exponential growth. In the blockchain space, the same opportunities exist, but lots of hard work is still to be done.

In the end, however, people are the ones accessing the code. As Meltem Demirors of the Digital Currency Group put it: “People are underlying everything. People, not technology. So we need better tools and standards around how cryptocurrency is stored and how it is exchanged. . .The user experience in blockchain today is not very friendly.”

However, panelists brought up the sheer newness of blockchain technology — which may serve to ease worries over its ease of use problem.

Over time, the emergence of the internet plays into a larger story of value transfer online functions and evolves. Protocols for compute, storage, and verification will make up different levels of the global blockchain networks. Innovations will likely take a decade or two to develop fully and at scale, but will simultaneously add infrastructural substance to managing the industry-wide deployment of blockchain technology. Just as the, TC/IP protocol took decades to emerge, Blockchain protocols will need to be designed to both proactively and reactively handle challenges faced from regulators and scammers alike.

Matt Roszak, Founding Partner of Tally Capital, spoke to the nascent nature of blockchain technology:

“We are no where near the hype cycle on blockchain. . .20%, maybe rounding up on this. . .This is a 1000x opportunity. We have so much to build. Think about Uber in 1997, we needed to build so many things first to have Uber in 2007. We will need billions of dollars more in investment to move things on the rails that are blockchain”

Building equity trading directly into these protocols will enable for their proliferation. Eventually blockchains can make a huge impact and jump old tech just like mobile phones did.

Overall, the panels showed the growing interest in cryptocurrency among the wider financial services and FinTech crowd. Blockchain and cryptocurrency remain hot topics at the event. Coders, industry players, and investors alike are thinking along similar long term lines with a vision towards adopting blockchain technology into a wider set of walls.

It won’t be an easy ride, but discussion between industry leaders is helping to pave the path for future collaborations.

What do you think about Vitalik Buterin’s comments on Ethereum? What takeaway themes were these from the other two panels featured here? Share your thoughts in the comments below!

Images courtesy of Ryan Strauss, Ethereum.org.

The post Money 20/20 Recap: Ethereum, Consumer Protection, Investment appeared first on Bitcoinist.net.

If you have an interest in learning about online currencies that are trending then you need to read “Bitcoins: How to Invest, Buy and Sell.” Bitcoins seem to be here to stay as since its creation, it has stood the test of time and is now being accepted by

Price: $ 5.75

Sold by Wal-Mart.com USA, LLC