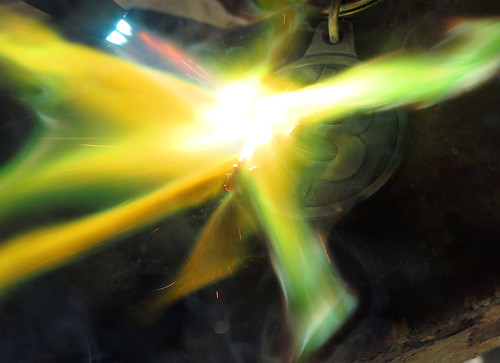

Bitcoin 5-axis yellow flamesIMG_7684

Image by btckeychain

Attacking a Bitcoin keychain with an acetylene torch resulted in some interesting photos.

http://ift.tt/eA8V8J

Over the past few years, bitcoin solidated its title as “the global currency” by outperforming reserve currencies and assets worldwide. The rising value of bitcoin and its decentralized nature have led high profile investors and traders to consider bitcoin as a safe asset.

Upon the election of Donald Trump, the price of bitcoin immediately surged amid global market instability. Australian stock markets lost US32 billion overnight, while American markets rapidly declined in value. One of the very few assets that experienced an increase in value is bitcoin, primarily due to its separation from the global economy.

Most assets and currencies, including US dollars, precious metals and stocks are heavily reliant on the performance of certain markets. Once a major asset sees a decline, others decrease in value as well, demonstrating a domino-like effect.

Bitcoin is a truly unique global asset that is decentralized and relies on its independent market demand for its value. Thus, other than its demand, external variables are less likely to affect its value and price trend.

The concept that bitcoin is free from the control of the government, central banks and authorities led investors to consider bitcoin as gold 2.0, as a global asset with high liquidity, enhanced conversion rates, freedom from power and monopoly, and movability.

In times of global market instability, stable assets such as gold, Swiss francs and bitcoin usually experience a significant surge in demand. This can be seen in the cases of Trump election, China’s stock market crash earlier this year and the Chinese central bank’s announcement to regulate wealth management products last month.

Thus, leading VC ARK Investment’s Blockchain Products Lead Christopher Burniske stated in an interview that investors, traders, companies and even average people see bitcoin as a “disaster hedge,” which simply means a safe asset to avoid economic and market turmoil.

“This is people turn to it as what i like to call disaster hedge, due to its non-correlation with the capital markets,” said Burniske.

YTD performance:

Gold: +16%

Bitcoin: +66%— Barry Silbert (@barrysilbert) November 11, 2016

//platform.twitter.com/widgets.js

He also noted that as capital markets recovered after the initial shock amid the election of Trump, bitcoin lost a fair amount of its gains. Burniske explained that for the most part, bitcoin outperforms itself in terms of price and market value during economic stability but loses some of its value when markets flourish.

“In terms of going forward, something really interesting that i noticed is, as the capital markets recovered…

Investors See Bitcoin as Gold 2.0 Amid Global Market Instability

No comments:

Post a Comment